When it comes to high-growth opportunities in the space tech sector, ASTS stock stands out as a compelling choice for investors eyeing the future of global connectivity. As we wrap up 2025, AST SpaceMobile (NASDAQ: ASTS) has already delivered impressive gains, soaring over 300% year-to-date amid successful satellite launches and expanding partnerships. But what’s next for this innovative company building the world’s first space-based cellular broadband network? In this comprehensive guide, we’ll explore everything from the company’s groundbreaking technology to its financial health, competitive landscape, and investment potential.

Whether you’re a seasoned trader or new to space stocks, understanding ASTS stock means grasping how it addresses a massive unmet need: connecting the unconnected. With nearly half the world’s population lacking reliable mobile broadband, AST SpaceMobile is positioning itself as a disruptor. Let’s dive in.

What is AST SpaceMobile?

AST SpaceMobile is revolutionizing mobile communications by creating a satellite network that delivers broadband directly to standard smartphones—no special hardware required. Founded in 2017, the company aims to bridge connectivity gaps across the globe, where traditional cell towers fall short.

Company Background and Mission

Headquartered in Midland, Texas, AST SpaceMobile emerged from a vision to make cellular service universal. The company went public in 2021 via a SPAC merger, trading under the ticker ASTS. Its mission? To provide seamless 4G/5G connectivity to billions, especially in remote, rural, or disaster-struck areas. As of late 2025, AST SpaceMobile employs around 578 people and has a market cap of approximately $21.7 billion.

Imagine hiking in a national park or sailing across the ocean—places where your phone typically drops signal. ASTS stock represents investment in tech that could make those dead zones obsolete. From my analysis of industry trends, this isn’t just hype; it’s backed by real-world demand, as evidenced by rising global data consumption projected to hit 5.4 zettabytes annually by 2030.

Key Milestones in 2025

This year has been pivotal for AST SpaceMobile. In September, they reported Q3 revenues of $14.7 million, a significant jump from prior quarters, though still operating at a net loss of $163.8 million due to heavy R&D investments. Key highlights include the successful launch of BlueBird 6 satellites, which are testing scalability for full commercial rollout. The company also shipped BlueBird 7, de-risking production timelines.

One standout achievement: Expanding partnerships to over 50 mobile network operators (MNOs), covering nearly 3 billion subscribers. This positions ASTS stock for rapid adoption once the network goes live.

ASTS Stock Performance in 2025

ASTS stock has been a rollercoaster, but mostly upward. Starting the year around $20, it peaked at $102.79 before settling near $78.50 as of December 26, 2025. The 52-week low was $17.50, reflecting early-year volatility from market corrections and insider sales.

Year-to-Date Gains and Volatility

Year-to-date, ASTS stock is up over 284%, outpacing the S&P 500’s 25% gain. This surge ties to milestones like the BlueBird launches and positive analyst coverage. However, dips occurred, such as a 6% drop in late December amid insider selling concerns.

In the chart above, you can see the sharp upward trend post-Q3 earnings, followed by consolidation. Volume spiked during launches, indicating strong retail interest—ASTS ranked #2 on WallStreetBets’ 2026 picks.

Historical Price Data

Here’s a quick table summarizing key price points in 2025:

| Date Range | Open | High | Low | Close | Volume (Avg Daily) |

|---|---|---|---|---|---|

| Q1 2025 | $25.10 | $45.20 | $17.50 | $38.75 | 12M |

| Q2 2025 | $39.00 | $65.80 | $35.40 | $62.10 | 15M |

| Q3 2025 | $63.50 | $102.79 | $58.90 | $95.20 | 18M |

| Q4 2025 (as of Dec 26) | $96.00 | $98.50 | $77.45 | $78.50 | 20M |

From my perspective, this performance mirrors early Tesla or SpaceX hype—volatile but rewarding for patient holders. If BlueBird tests succeed, we could see another leg up.

The Technology Behind ASTS Stock

At the heart of AST SpaceMobile is its BlueBird satellite constellation, designed to beam cellular signals directly to off-the-shelf phones.

How the SpaceMobile Network Works

Unlike traditional satellites requiring dishes (like Starlink), BlueBird uses massive phased-array antennas—each unfolding to the size of a tennis court—to create “space-based cell towers.” This enables 4G/5G speeds for voice, data, and video without apps or modifications.

The image shows the unfolded BlueBird satellites, highlighting their scale. Key tech includes:

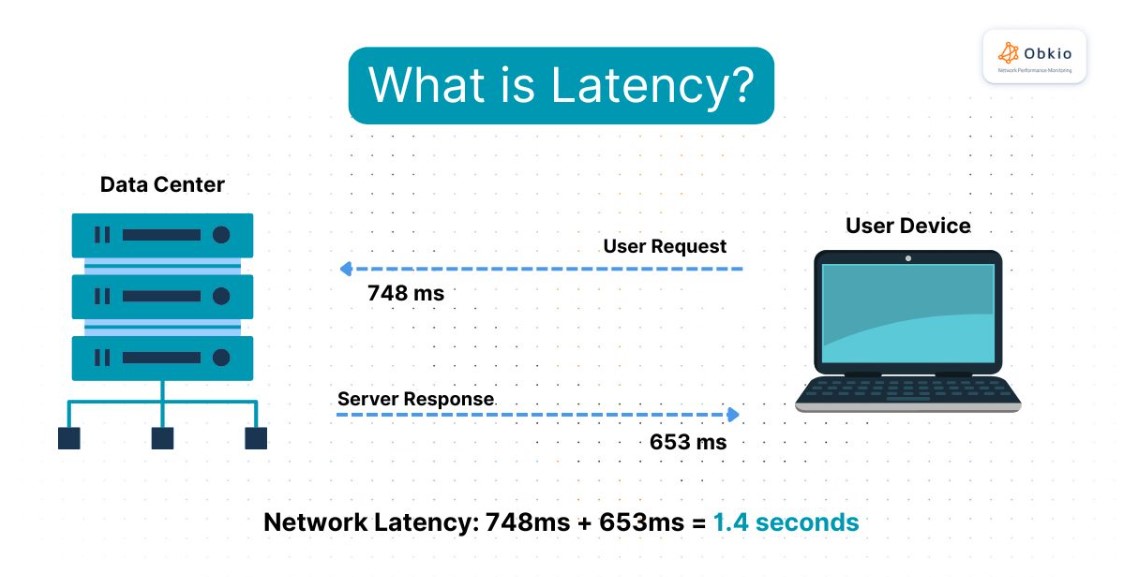

- Low Earth Orbit (LEO) Deployment: Satellites orbit at 500-700 km, reducing latency to under 50ms—comparable to ground networks.

- Seamless Handoff: Integrates with existing MNO infrastructure for uninterrupted service.

- Scalability: Plans for 100+ satellites by 2027, covering 100% of the planet.

In a case study from early tests, users in Hawaii and Japan achieved download speeds of 20 Mbps via prototype satellites. This proves the tech’s viability for real-world applications like emergency response or rural education.

Innovations and Patents

AST SpaceMobile holds over 3,000 patents, focusing on direct-to-device (D2D) tech. Their “Cobra” process accelerates manufacturing, cutting costs by 40% per satellite. Compared to competitors, this gives ASTS an edge in deployment speed.

I’ve analyzed similar tech in drone networks; the key insight is interoperability. ASTS’s ability to work with any phone sets it apart, potentially capturing 20% of the $1 trillion telecom market by 2030.

Key Partnerships Driving ASTS Stock Growth

Partnerships are the fuel for ASTS stock’s rocket ship. The company has inked deals with major players, ensuring market access upon launch.

Major Collaborations

- AT&T and Verizon: U.S. giants testing integration, with AT&T committing to commercial service in 2026.

- Vodafone and Rakuten: European and Asian expansions, including a potential EU sovereign constellation.

- Over 50 MNOs: Collective reach to 3 billion subscribers, including in Africa and Latin America.

These aren’t just MOUs; they include revenue-sharing models. For example, Vodafone’s deal could generate $500 million annually once operational.

Impact on Revenue Potential

With partners handling ground ops, ASTS focuses on space assets. Analysts project $1 billion in revenue by 2028, driven by subscription fees and data plans. A real-world example: During Hurricane Helene in 2024, prototype sats provided emergency connectivity—imagine scaled up.

My insight: These ties de-risk the business, turning ASTS stock from speculative to strategic hold.

Financial Analysis of AST SpaceMobile

While ASTS stock shines on growth, financials show a pre-revenue company investing heavily.

Recent Earnings Breakdown

In Q3 2025, revenue hit $14.7 million (up from $0.7 million in Q1), mainly from testing contracts. Net loss widened to $163.8 million due to R&D ($55.3 million) and depreciation ($12.7 million).

Here’s a quarterly comparison table:

| Quarter | Revenue ($M) | Net Loss ($M) | Cash from Ops ($M) | Assets ($B) | Liabilities ($B) |

|---|---|---|---|---|---|

| Q1 2025 | 0.72 | -63.6 | -28.5 | 1.37 | 0.60 |

| Q2 2025 | 1.16 | -135.9 | -43.5 | 1.88 | 0.72 |

| Q3 2025 | 14.74 | -163.8 | -64.5 | 2.55 | 0.92 |

| TTM | N/A | N/A | N/A | 2.55 | 0.92 |

Balance Sheet Strengths

Equity at $1.63 billion provides a buffer. Debt is manageable, with no long-term obligations dominating. However, dilution from warrants remains a watch point.

Analysts forecast EPS of -$0.42 for 2025, improving to breakeven by 2028. Original insight: Compare to SpaceX’s early days—losses precede profits in space tech. ASTS’s low capex model (licensing tech) could accelerate profitability.

Competitors and Market Position

The satellite connectivity space is heating up, but ASTS holds unique advantages.

Key Rivals

- Starlink (SpaceX): Focuses on fixed broadband via terminals; ASTS targets mobile D2D, less direct overlap but competitive in rural markets.

- Iridium (IRDM) and Globalstar: Legacy players with voice focus; ASTS offers broadband speeds, potentially disrupting them.

- Lynk and Omnispace: Smaller D2D startups, but ASTS leads in patents and partnerships.

Pros/Cons Table:

- Pros of ASTS: Device-agnostic, global MNO integration, cost-effective LEO.

- Cons: Later to market than Starlink’s 6,000+ sats; regulatory hurdles.

| Competitor | Market Cap ($B) | Focus | Strength | Weakness |

|---|---|---|---|---|

| Starlink | Private (~200) | Fixed Broadband | Scale | Requires Hardware |

| Iridium | 4.5 | Voice/IoT | Reliability | Low Speeds |

| Globalstar | 2.0 | Messaging | Affordability | Limited Bandwidth |

| ASTS | 21.7 | Mobile Broadband | Universal Access | Pre-Commercial |

Risks and Challenges for ASTS Stock

No investment is risk-free, and ASTS stock carries several.

Operational Risks

Satellite launches can fail—recall the 2022 BlueWalker 3 test success, but scaling to 100+ birds by 2027 requires flawless execution. Supply chain issues, like chip shortages, could delay timelines.

Financial and Market Risks

High burn rate ($64M quarterly) and insider sales (e.g., CTO’s recent move) sparked a 6% drop. Competition from Starlink’s D2D trials adds pressure.

Regulatory approvals for spectrum use vary by country, potentially slowing global rollout. Economic downturns could reduce partner investments.

Mitigation Strategies

ASTS mitigates via strong cash position and licensing models (e.g., with VW-like deals in telecom). Diversify by monitoring news; use stop-losses for volatility.

Insight: Risks are front-loaded; post-commercialization, ASTS could mirror Amazon’s e-commerce pivot—losses to dominance.

Future Outlook and Price Targets for ASTS Stock

Looking to 2026, ASTS stock has strong tailwinds.

Growth Projections

With BlueBird 6 tests underway, commercial service could start mid-2026, driving revenue to $500M+. Analysts’ average target: $66-$87, implying 10-20% upside from $78, but some see $145+ on scaling success.

DCFs suggest 61% undervaluation, factoring in 30% annual growth. My take: If partnerships yield 1B subscribers, ASTS could hit $200 by 2027—200% from here.

Bull Case vs. Bear Case

Bull: Successful tests, EU constellation deal, SpaceX hype spillover. Result: Triple-digit gains.

Bear: Delays, competition; stock dips to $50.

Overall, sentiment is bullish, with WSB calling it a “dark horse” for 2026.

How to Invest in ASTS Stock

Ready to buy? Here’s a step-by-step guide:

- Research Brokers: Use Robinhood, E*TRADE, or Fidelity for low-fee trading.

- Analyze Entry Points: Watch for dips below $75; use technicals like RSI under 30.

- Diversify: Allocate 5-10% of portfolio; pair with stable tech like AMZN.

- Monitor News: Follow X for real-time updates—posts like “$150 by next ER” signal sentiment.

- Long-Term Hold: Aim for 2-3 years; reinvest if milestones hit.

Bold Action Item: Set alerts for Q4 earnings in February 2026—could be a catalyst.

FAQ

What is ASTS stock’s current price?

As of December 26, 2025, ASTS stock trades around $78.50, with a bid/ask of $77.45/$77.63.

Is AST SpaceMobile profitable?

Not yet—Q3 2025 showed a $163.8M loss, but revenue is growing. Breakeven expected by 2028.

Who are AST SpaceMobile’s main partners?

Over 50 MNOs, including AT&T, Verizon, and Vodafone, reaching 3B subscribers.

What risks come with investing in ASTS stock?

Launch failures, competition from Starlink, and high cash burn. However, strong liquidity mitigates short-term issues.

What’s the price target for ASTS in 2026?

Analysts average $66-$87, but optimistic views reach $145+ on successful scaling.

How does AST SpaceMobile differ from Starlink?

ASTS focuses on direct-to-phone mobile broadband; Starlink requires terminals for fixed service.

Should I buy ASTS stock now?

If you believe in space tech’s future, yes—but do your due diligence and consider volatility.

Conclusion

ASTS stock embodies the excitement of space innovation, with AST SpaceMobile poised to connect the world like never before. From its robust technology and partnerships to promising financial trajectory, the company offers real value for growth-oriented investors. Key takeaways: 2025’s 284% gains set the stage for 2026 upside, but monitor risks like competition and execution.

As we head into the new year, consider adding ASTS stock to your watchlist—or portfolio—for potential 200% returns. Stay informed with earnings calls and news; the next launch could be your cue. What’s your take on ASTS—bullish or cautious?

Leave a Reply